Claims Processing Automation: AI-Driven Claims Management

Table of Content

What Is Claims Processing Automation?

Claims Processing Automation leverages automation tools like Artificial Intelligence (AI), Machine Learning (ML), and Natural Language Processing (NLP) to automate claims processes in healthcare and insurance. Automated claims processing software utilizes these technologies to analyze data, and process claims efficiently, improving customer satisfaction by lessening wait times and reducing the risk of errors by improving data accuracy and performing regular compliance checks.

Problems in Manual Claims Processing

Customers today demand convenience and real-time communication from service providers. With online claims management, insurers’ agents are expected to be available 24/7. As innovative players enter the market, pricing and quality are no longer enough to retain customers. Necessitating a focus on exceptional customer experiences. Manual claims processing often lacks consistency in task management, leading to dissatisfaction when agents calculate different payouts for identical claims. Claims Processing Automation tools and Intelligent Automation solutions ensure consistent service delivery, preventing inaccuracies

Inconsistent Service Delivery and Process Inefficiencies

Customers may experience dissatisfaction when agents calculate different payouts for identical claims due to the lack of standardized processes. If one claim is prioritized over another without proper time management in manual workflows, inaccuracies can occur, resulting in a suboptimal customer experience. Claims Processing Automation tools and Intelligent Automation solutions address these issues by ensuring consistent task management and service delivery. This prevents disparities in claim payouts and prioritization.

Data Integration Challenges and Inaccurate Information

Claims Processing Automation tools address the challenges of inaccurate and outdated data by providing a centralized system for data integration. Automation tools eliminate such inaccuracies, enhancing the customer experience. Moreover, these tools reduce operational costs by streamlining processes and eliminating the need for agents to re-key information between systems.

High Operational Costs

Keeping costs in check is a top priority when modernizing claims processing operations. Without Automation tools and Intelligent Automation solutions, systems often remain siloed and not integrated. Agents often have to re-key information between systems, introducing errors, and additional operational costs. Staggeringly, only 5% of insurers are fully digitized or automated with Automation tools. Implementing Intelligent Automation solutions and leveraging automation tools is critical to streamline processes, eliminate redundant data entry, and optimize operational costs.

Benefits of Claims Processing Automation

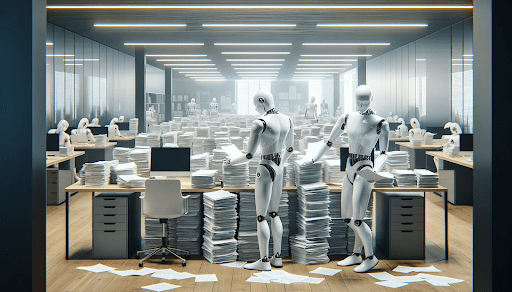

Claims processes are ripe for automation due to their slow, repetitive tasks which are prone to error. When you deploy intelligent digital workers through Automation tools, you’re enabling them to take over these tedious tasks. These digital workers powered by Claims Processing Automation and Intelligent Automation solutions are available 24/7 and work with 100% accuracy. They free your staff to focus on higher-value, complex processes, such as unique case files, potential fraud investigations, and improving customer claims experience.

Elevating Customer Experience

Claims processing automation streamlines the customer journey, enabling real-time access to claim statuses and automated responses through chatbots, reducing the need for human interaction. Claims processing automation expedites resolution times and enhances customer satisfaction.

Cost Optimization

By automating manual tasks, such as data entry for claim forms, operating costs are reduced as fewer employees are required for these repetitive tasks. Claims processing automation allows your workforce to focus on higher-value, strategic endeavors, further enhancing cost savings.

Fraud and Risk Mitigation

Automated systems incorporate fraud detection algorithms and machine learning models to identify suspicious claims patterns, mitigating financial losses. Regular compliance checks are performed, reducing the risk associated with non-compliance.

Efficient Document Management

With automated systems from Automation tools, claims data can be organized and stored electronically. This enables easier document retrieval and enhanced security – essential requirements in healthcare and insurance industries.

Precision and Accuracy

Claims Processing Automation minimizes human errors in the claim handling process, from calculations to data entry and manual review. This precision helps monitor claims costs and prevents overpayments, underpayments, and processing delays.

Streamlined Processes

Claims Processing Automation eliminates manual tasks, resulting in faster claim processing times and resolution. This increased efficiency allows for a seamless claims management experience, fostering operational excellence.

Automation tools offer multitudes of short and long-term benefits. This optimizes your claims management processes and driving operational excellence across various dimensions through Intelligent Automation solutions.

Technologies Used in Claims Processing Automation

Intelligent Automation (IA) Solutions

Intelligent Automation solutions orchestrate complex workflows, automate decision-making, and optimize resource allocation within claims operations by integrating AI, RPA, and cognitive technologies. With Automation tools and Intelligent Automation solutions, users can design end-to-end automation processes, dynamically adapt to changing business conditions, and deliver personalized customer experiences.

Artificial Intelligence (AI) Capabilities

AI-powered algorithms in Automation tools enable predictive analytics, pattern recognition, and anomaly detection, optimizing claims decision-making, detecting fraudulent activities, and forecasting claim outcomes with greater accuracy. These algorithms analyze vast datasets, identify emerging trends, and provide actionable insights, enhancing operational agility and risk management.

Robotic Process Automation (RPA) Efficiencies

RPA software robots in Claims Processing Automation emulate human actions, automating repetitive, rule-based tasks like data entry, document verification, and status updates across multiple systems and applications within the claims process. RPA streamlines end-to-end claims handling, improves productivity, reduces errors, and enables scalability.

Conversational Interfaces for Engagement

AI and natural language understanding (NLU) technologies power chatbots and virtual assistants in Automation tools, enabling policyholders to initiate claims, track status, and obtain assistance through conversational interfaces on websites, mobile apps, and messaging platforms. These automation interfaces enhance customer engagement, reduce call center volumes, and provide round-the-clock support

Intelligent Document Processing (IDP) Automation

IDP solutions in Claims Processing Automation leverage advanced OCR, NLP, and machine learning to extract relevant information from unstructured documents like claim forms, invoices, and supporting documents. IDP automates data capture, validation, and classification, reducing manual data entry and accelerating claims processing workflows.

Summary

By strategically integrating these technologies, users of Automation tools can achieve significant improvements in efficiency and customer satisfaction. Careful planning, stakeholder collaboration, and continuous optimization are crucial to maximize the value of automation investments and drive sustainable business outcomes.

While these Claims Processing Automation technologies may seem daunting for small businesses, Robylon AI makes it possible for industries of every size. Robylon AI empowers users with an AI Copilot that understands their needs and can guide, help, and take actions using plain English commands. This AI Copilot can interpret user commands, break them into tasks, and execute seamlessly leveraging RPA, AI, IDP, and conversational interfaces.