Top 11 B2B Payment Automation Software

Table of Content

In today’s dynamic business sector, efficiency and speed are critical, especially in financial operations. B2B payment automation is changing how businesses handle transactions by converting manual operations into simplified, automated workflows. This change decreases errors and delays, hence increasing overall corporate efficiency.

Historically, business payment processing involved a maze of paperwork and manual approvals, resulting in inefficiencies. Automated payment solutions solve these problems by digitizing and automating the entire payment process. This guarantees that payments are made on schedule and accurately, reducing the likelihood of human error and fraud.

In this blog, we will discuss what B2B payment automation is and the numerous benefits of automated payment solutions.

What is B2B payment automation?

B2B payment automation is the use of automated payment technologies to accelerate and optimize business payment processing among organizations. It involves digitizing and automating the entire payment cycle, from invoicing to reconciliation, resulting in rapid and accurate transactions with minimal human participation. This technology improves efficiency, accuracy, and overall financial management in B2B transactions.

Benefits of Automated Payment Solutions

1. Increased Efficiency

B2B payment automation significantly enhances the efficiency of business payment processing by streamlining workflows and reducing the need for manual intervention. Automation handles repetitive tasks such as data entry, invoice matching, and payment approvals, freeing up valuable time for employees to focus on more strategic activities.

2. Accuracy and Reduced Errors

One of the major advantages of automated payment solutions is the reduction of errors that often occur with manual processing. Automation ensures that data is consistently and accurately recorded, which minimizes the risk of human errors such as duplicate payments, incorrect amounts, or missed deadlines.

3. Cost Savings

By automating business payment processing, companies can achieve substantial cost savings. Manual payment processes are labor-intensive and require significant administrative resources, including personnel, paper, and physical storage. Payment automation reduces the need for these resources, cutting down on operational costs.

4. Enhanced Security

Automated payment solutions provide a more secure environment for handling financial transactions. Automation reduces the risk of fraud and unauthorized access by implementing robust security measures such as encryption, secure access controls, and audit trails. These features ensure that sensitive financial data is protected throughout the payment process.

5. Improved Cash Flow Management

Effective cash flow management is critical for the financial health of any business. B2B payment automation offers real-time tracking and comprehensive reporting features that provide businesses with clear visibility into their cash flow status. Automated systems can generate detailed reports on outstanding invoices, payment schedules, and cash positions, enabling businesses to make informed financial decisions.

How to select the right B2B payment automation

1. Assess Your Business Needs

Identify specific requirements for your business payment processing. Determine the volume of transactions, types of payments, and integration needs with existing systems.

2. Evaluate Security Features

Ensure the automated payment solutions offer robust security measures, such as encryption, fraud detection, and secure access controls to protect sensitive financial data.

3. Check Integration Capabilities

Verify that the B2B payment automation solution can seamlessly integrate with your existing ERP, accounting software, and other financial systems to ensure a smooth workflow.

4. Consider Scalability

Choose a solution that can grow with your business. The automated payment solutions should be able to handle increasing transaction volumes and adapt to future business expansions.

5. Look for Customization Options

Ensure the solution offers customizable features to meet your unique business processes and payment workflows. Flexibility in business payment processing is essential for tailoring the system to your needs.

6. Examine Reporting and Analytics

Select a system that provides comprehensive reporting and analytics capabilities. This helps in tracking payments, monitoring cash flow, and making informed financial decisions.

7. Review Customer Support and Training

Opt for a provider that offers robust customer support and training resources. Effective support ensures smooth implementation and ongoing assistance for your B2B payment automation system.

8. Compare Costs and ROI

Evaluate the costs involved, including setup fees, transaction fees, and ongoing maintenance. Compare these costs with the potential return on investment (ROI) from efficiency gains and cost savings.

9. Read Reviews and Testimonials

Research user reviews and testimonials to gauge the experiences of other businesses with automated payment solutions. Real-world feedback can provide valuable insights into the system’s performance and reliability.

10. Trial and Testing

If possible, request a demo or trial period to test the B2B payment automation solution in your business environment. Hands-on experience will help you determine if the system meets your needs effectively.

Top 11 B2B Payment Automation Software

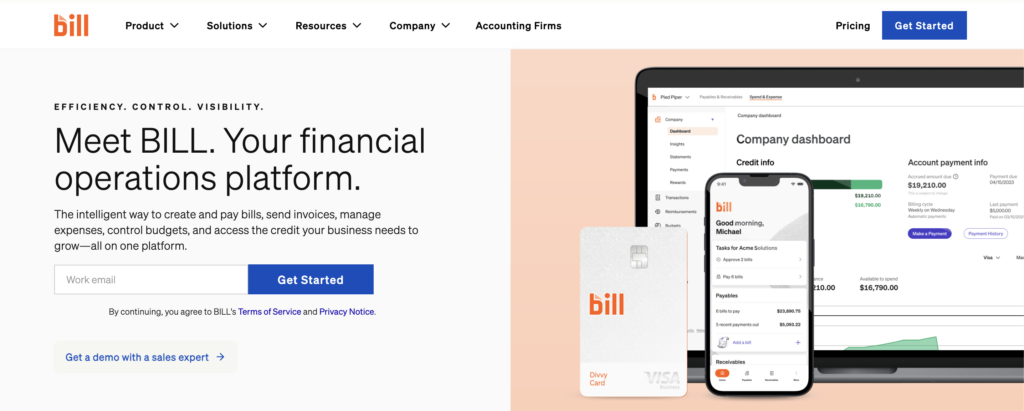

1. Bill.com

Bill.com is a leading provider of B2B payment automation that specializes in streamlining business payment processing through its automated payment solutions. It offers features such as digital invoicing, payment scheduling, and approval workflows. By integrating with major accounting software like QuickBooks and Xero, Bill.com reduces manual data entry, enhances efficiency, and ensures that all transactions are processed accurately and on time.

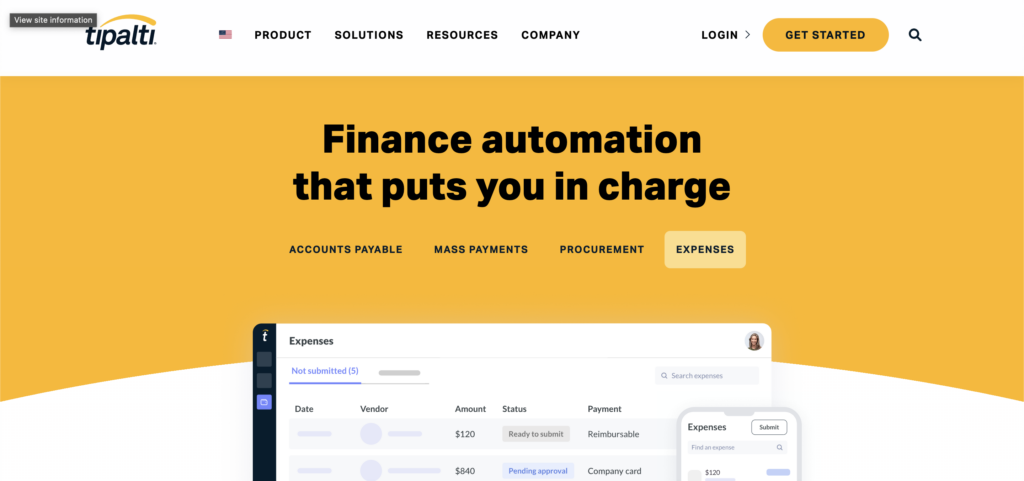

2. Tipalti

Tipalti provides an end-to-end B2B payment automation platform that simplifies global payments and supplier management. Its automated payment solutions include tax compliance and robust AP automation features. By handling everything from invoice processing to payment execution, Tipalti reduces the risk of errors and fraud. It also ensures compliance with international tax regulations, which is crucial for businesses operating globally.

3. AvidXchange

AvidXchange focuses on automating the entire accounts payable process, offering B2B payment automation that includes invoice processing, payment execution, and detailed real-time reporting. Its automated payment solutions are designed to improve efficiency, reduce manual errors, and provide better visibility into a company’s cash flow and expenses.

4. SAP Ariba

SAP Ariba offers a comprehensive suite of payment automation tools that cover the entire procure-to-pay process. Its automated payment solutions include electronic invoicing, payment processing, and supplier collaboration, which help streamline procurement and financial transactions. By improving compliance and enhancing supplier relationships, SAP Ariba provides businesses with a more efficient and transparent business payment processing environment.

5. Coupa

Coupa provides a cloud-based B2B payment automation platform that integrates AP automation, expense management, procurement, and payment processing. Its automated payment solutions offer real-time analytics and reporting, which help businesses increase efficiency, reduce costs, and gain better control over their financial operations.

6. PaySimple

PaySimple is an all-in-one solution for B2B payment automation, combining invoicing, payment processing, and customer management. Its automated payment solutions simplify payment collections and reduce administrative tasks by integrating various financial functions into one platform. This seamless approach to business payment processing improves efficiency and enhances customer relationships, making

7. Square for Business

Square for Business offers a range of payment automation tools, including payment processing, invoicing, and financial reporting. Its automated payment solutions integrate with Square’s point-of-sale (POS) systems, providing a comprehensive platform for managing both online and in-person transactions. Square’s intuitive interface and robust features make business payment processing simple and efficient, particularly for small to medium-sized enterprises.

8. Adyen

Adyen is a global B2B payment automation platform known for its wide range of payment processing capabilities, risk management, and revenue optimization. Its automated payment solutions support various payment methods, enhancing security and optimizing revenue across multiple channels. Adyen’s advanced technology and global reach make it a preferred choice for large enterprises looking to streamline their business payment processing and improve operational efficiency.

9. Veem

Veem leverages blockchain technology to offer cost-effective B2B payment automation for international transactions. Its automated payment solutions provide competitive exchange rates and transparent fees, simplifying cross-border payments. Veem’s innovative approach to business payment processing reduces transaction costs and speeds up payment times, making it an excellent choice for businesses with global operations.

10. QuickBooks Payments

QuickBooks Payments integrates seamlessly with QuickBooks accounting software, providing payment automation that includes invoicing, payment processing, and comprehensive financial management. Its automated payment solutions simplify business payment processing by automating invoice creation, payment reminders, and transaction recording. This integration ensures accurate financial records and helps small businesses manage their finances more effectively.

11. Zoho Books

Zoho Books offers a range of B2B payment automation features, including invoicing, expense management, payment processing, and detailed financial reporting. Its automated payment solutions integrate with other Zoho products, providing a unified platform for managing all aspects of business payment processing. Zoho Books’ comprehensive automation capabilities help businesses streamline their financial workflows, reduce errors, and gain valuable insights into their financial health.

Robylon AI enhances B2B payment automation through personalized workflow creation, boosting efficiency, and enabling seamless integration across various tools and applications.

Want to know more? Schedule a demo with us.

FAQs

1. What is B2B payment automation, and why is it important?

B2B payment automation refers to using technology to streamline and automate the process of making payments between businesses. It’s important because it reduces manual errors, speeds up transactions, and improves financial efficiency.

2. What types of businesses can benefit from B2B payment automation?

Businesses of all sizes can benefit from B2B payment automation, but it is particularly beneficial for those with high transaction volumes, global operations, complex payment workflows, or a need to improve financial controls.

3. What are the security considerations when implementing B2B payment automation?

Security considerations include data encryption, secure access controls, compliance with industry regulations (such as PCI-DSS for payment data), and monitoring for fraudulent activities to protect sensitive financial information.

4. How does B2B payment automation integrate with existing financial systems?

B2B payment automation solutions typically offer integration capabilities with popular ERP systems, accounting software (like QuickBooks, Xero), and other financial management tools. This integration ensures seamless data flow and reduces manual data entry.

5. What are the potential challenges of implementing B2B payment automation?

Challenges may include initial setup costs, integration complexities with legacy systems, resistance to change from employees, and ensuring compliance with regulatory requirements across different geographies.

6. How can businesses measure the ROI of B2B payment automation?

Businesses can measure ROI by evaluating cost savings from reduced administrative tasks, faster payment processing times, early payment discounts, improved cash flow management, and enhanced operational efficiency.