Invoice Processing Automation: Improve Financial management

Table of Content

In the fast-paced world of business, every minute counts. However, manual invoice processing can be labor-intensive and error-prone, depleting resources and impeding expansion. It’s time to adopt a more effective strategy. Financial management has therefore been made easier with the development of invoice automation, which is powered by AI assistant.

This transformative solution reimagines how organizations handle their finances, from receipt to payment. By integrating AI assistant, invoice automation streamlines workflows, enhances efficiency, and reduces errors. Businesses can reclaim critical time and resources while ensuring accuracy and compliance at every stage of the invoicing cycle.

What is Invoice processing?

Invoice processing encompasses the complete workflow of managing invoices within a company, spanning from receipt to payment. This includes responsibilities such as receiving and scanning bills, ensuring accuracy, matching purchase orders, obtaining permissions, and initiating payments.

Automating repetitive duties such as data entry, invoice validation, and payment scheduling accelerates the invoicing cycle, ensuring prompt payments and enhancing financial process management. Utilizing AI assistant and invoice automation, businesses can streamline operations, reduce manual efforts, and achieve greater control over their financial workflows.

The Advantages of Automated Invoice Processing

- The accounts payable department uses invoice automation and AI Assistant processing software to speed up the processing of vendor bills, increase control over internal processing activities, and streamline invoice processes.

- Software for invoice automation is similar to AP Automation. In addition to automatically designating approvers and submitting invoices into financial systems for payment, these automated invoice processing systems using their AI assistant assist accounts payable teams in automating the capture, coding, and transmission of bills for approval.

- Through leveraging AI assistant, and invoice automation, these systems empower accounts payable teams to streamline workflows, improve efficiency, and ensure accurate invoice management.

Why is Invoice Processing Automation Essential for Your Business?

Manual invoice processing, once the norm, is quickly becoming outdated in the face of evolving technologies. Instead, businesses are turning to invoice automation solutions that use AI assistant to streamline operations, drive cost savings, and gain a competitive edge. Here are the reasons why automated invoice processing is now required for companies of all sizes, rather than only being a choice.

1. Enhanced Process Efficiency:

Automated invoice processing eliminates the need for manual data entry and validation, significantly reducing the time and effort required in invoice processing. Businesses can use advanced technology such as optical character recognition (OCR) and machine learning to automate recurring processes and speed up the entire billing cycle. By integrating invoice processing, AI assistant, and invoice automation, enterprises can streamline operations, improve productivity, and achieve more accuracy in invoice management.

2. Payment becomes Faster:

AI assistant help in prompt payment which is essential for maintaining positive relationships with suppliers and vendors. Invoice automation enables businesses to expedite payment approvals and processing, leading to faster payments and improved cash flow management.

3. Enhanced Visibility and Control:

Visibility into the invoicing process is crucial for effective financial management. Invoice automation uses AI assistant to provide real-time insights into invoice status, bottlenecks, and approval workflows. This transparency enables businesses to track and monitor their financial processes, identify areas for improvement, and make data-driven decisions.

4. Accuracy and Compliance:

Manual invoice processing is prone to errors, from typos in data entry to missed payments and discrepancies. These errors not only result in financial losses but also tarnish relationships with suppliers and hinder business operations. AI assistant ensures accuracy by extracting and validating invoice data with precision.

5. Scalability and Adaptability:

As businesses grow and evolve, so do their invoicing needs. Invoice automation solutions offer scalability and adaptability, accommodating changing volumes of invoices and business requirements. Whether it’s a small startup or a multinational corporation, these systems using AI can scale seamlessly to meet your needs, without compromising efficiency or accuracy.

By streamlining operations, improving accuracy, and enhancing visibility, automated invoicing systems empower businesses to drive growth, reduce costs, and stay ahead of the curve.

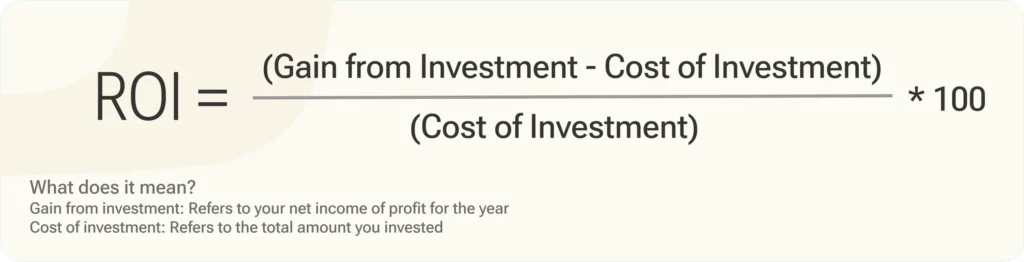

Measuring Success and ROI

Assessing the effectiveness of an invoice automation system involves tracking essential performance indicators (KPIs):

1. Processing Time:

Invoice processing measures the duration from invoice receipt to payment. A reduction in processing time signals enhanced efficiency.

2. Error Rate:

It monitors, instances of errors such as duplicates or data entry mistakes to gauge accuracy.

3. Cost per Invoice:

Invoice automation using AI assistant helps in calculating the expense associated with processing each invoice, encompassing labor and software costs. Lowering this cost indicates increased efficiency.

4. Invoice Approval Time:

AI assistant helps evaluate the duration taken for invoices to be approved, reflecting the efficiency of your approval workflow.

5. Supplier Satisfaction:

Invoice automation determines supplier satisfaction levels through surveys or feedback, as timely and accurate processing impacts business relationships.

To compute the ROI of invoice processing automation, compare benefits (savings, efficiency gains) against costs (software, training, maintenance).

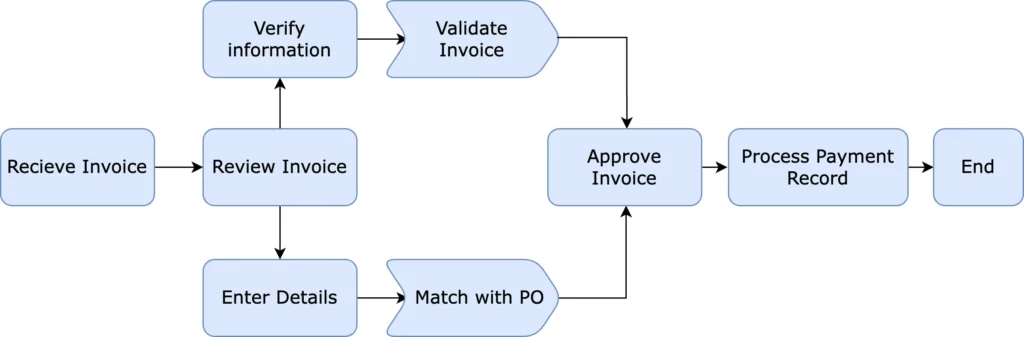

How does invoice processing automation work?

Invoice processing automation involves leveraging technology to streamline and expedite the handling of invoices within an organization. Here’s how it usually works:

1. Receipt of Invoices:

Invoices can be received through various channels, including email, or electronic data interchange (EDI). When invoices arrive, they are collected and kept in a centralized system.

2. Data Extraction:

Invoice automation software uses optical character recognition (OCR) technology to extract relevant data from invoices, such as vendor information, invoice numbers, date, line items, and amounts. This data extraction process ensures accuracy and eliminates the need for manual data entry.

3. Validation and Matching:

With AI assistant and invoice automation the extracted data is then validated against predefined criteria, such as purchase orders, contracts, and pricing agreements. Any discrepancies or exceptions are flagged for further review.

4. Approval Workflow:

Once validation is complete, invoices are routed through an approval workflow based on predefined rules and hierarchies. Approvers are notified of pending invoices and can review and approve them electronically, either individually or in batches.

5. Payment Processing:

Approved invoices are then scheduled for payment according to payment terms and supplier agreements. Invoice automated systems can generate payment files for electronic funds transfers (EFTs) or checks, which are then sent to the appropriate payment channels.

6. Reporting and Analytics:

Automated invoice processing systems provide real-time visibility into the invoicing process through dashboards and reports. Businesses can track invoice status, monitor key performance indicators (KPIs), and generate insights to optimize processes and improve financial management.

7. Integration with ERP Systems:

It seamlessly integrates with enterprise resource planning (ERP) systems, such as SAP, Oracle, or QuickBooks, to ensure data consistency and workflow efficiency. Integration enables the automatic updating of financial records and facilitates end-to-end process automation.

By automating repetitive tasks, reducing manual errors, and accelerating processing times, invoice processing automation improves efficiency, accuracy, and control over financial processes, ultimately driving cost savings and enhancing business performance.

By analyzing these metrics and continuously measuring success, businesses can select the optimal automated invoice processing software and ensure a successful implementation that delivers tangible benefits and ROI.

Conclusion

To wrap up, invoice processing offers a significant shift in financial management, providing businesses with enhanced efficiency, accuracy, and cost-effectiveness.

Robylon AI assists other companies in developing their own copilots. By leveraging advanced technologies and embracing automation, businesses can streamline their invoicing processes, reduce errors, and improve overall efficiency. In the future, it’s clear that invoice processing automation will continue to play a crucial role in driving business growth, enabling organizations to stay competitive in an increasingly digital and fast-paced world.